Accelerating MSME Financing: How are FinTechs Delivering Funds Within 24-48 Hours

India’s economic progress has largely been on an upward trajectory despite frequent bouts of global uncertainties and market volatility.

Promoting inclusive financial growth among key sectors of the economy will be imperative to keeping up the country’s economic growth momentum. There have been many top-down approaches taken by the government and regulatory bodies to widen financial inclusion. The 45-day payment rule for Micro, Small, and Medium Enterprises (MSMEs) was one such initiative that was introduced to ensure timely payments to the sector. As the stringent payment rules led to a disruption in business practices, the government is currently considering relaxing the rule in the upcoming Union Budget.

MSMEs are vital sectors of the economy and act as ancillary units to larger industries, nurturing budding entrepreneurs and incubating innovation across the value chain. Although the sector has shown impressive potential, a massive credit demand-supply mismatch leaves these businesses with poor working capital reserves.

Moreover, a study by EY highlights that 55% of SMEs require financing within 7 days. FinTech companies are seizing the opportunity to bridge the financing gap with unprecedented speed and efficiency. By streamlining loan application processes with smart automation and speeding up credit evaluation, FinTechs are enabling MSMEs to apply for and receive funds within just 24-48 hours of application.

From application to disbursement: A frictionless journey

Traditional lending processes often involve extensive paperwork, collateral requirements, and long approval times—making them impractical for thin-file MSMEs needing immediate working capital.

Given the urgency of accessing affordable credit—there is a growing need for a ‘next-generation credit decisioning framework’ and tech-enabled financial models to cater to MSME borrowers.

With technological advances showing tangible results in enhancing access to financial services, FinTechs are adopting business and operational models powered by cutting-edge technologies. Backed by FinTechs’ user-friendly interfaces and algorithm-driven assessments, MSMEs can complete the entire loan application process online, eliminating the need for physical documentation and laborious paperwork.

By creating hyper-personalised financial products and services, FinTechs are delivering a truly superior customer experience. Unlike traditional banks, which may take weeks to process loans, FinTechs use digital platforms and data analytics to streamline the lending process and ensure application-to-cash within 24-48 hours.

As a result, the lending value chains in the country have experienced significant digitisation right from the point of origination, credit assessment, and disbursements.

The credit bureau Experian reported that FinTechs are currently dominating the unsecured lending space.

These digital platforms leverage advanced machine learning algorithms and large volumes of real-time customer data packed with rich insights to lower operational costs and automate lending activities that were once highly manual. They use algorithms to assess creditworthiness based on real-time financial data, transaction histories, and other relevant metrics. This data-driven approach speeds up approvals and improves risk assessment accuracy, in turn enabling FinTechs to extend credit to a broader range of MSMEs.

Empowering MSMEs for growth and resilience

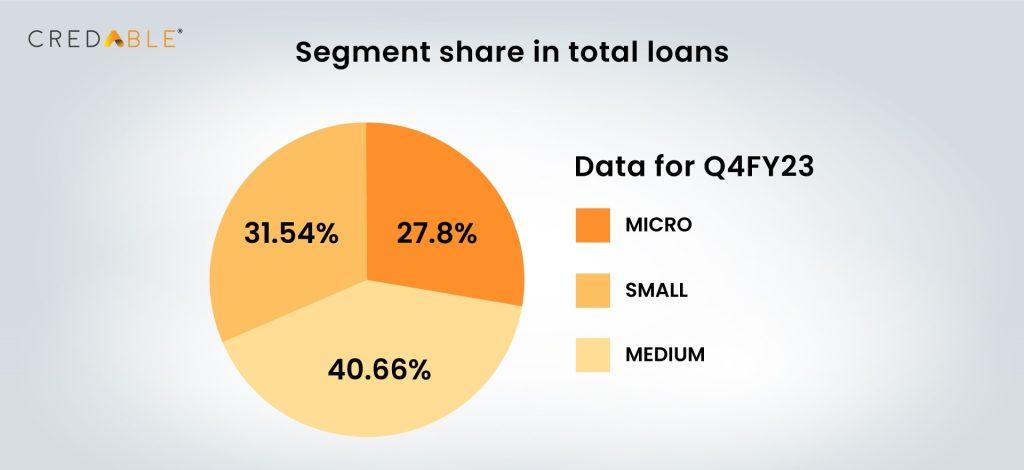

According to TransUnion CIBIL, the total loan distribution to the MSME sector includes 40.66% for small enterprises, 31.54% for medium enterprises, and 27.8% for micro-enterprises.

The good news is that, in recent years, the micro-segment with a credit exposure of less than INR 1 crore has registered 23% YoY growth in originations value.

Innovative credit-decisioning models and customer management frameworks supported by advanced analytics and low-code technology are enabling FinTechs to allow the wider use cases of their loan portfolio while ensuring high-quality lending decisions and proactive credit risk management.

Here are a few approaches taken by FinTechs to augment financial support for MSMEs:

- Tailored financial solutions

One of the key strengths of FinTechs lies in their ability to understand and cater to the diverse financial needs of MSMEs. Alternative data sources provide deeper insights into MSME finance, significantly improving credit underwriting and ensuring better-quality risk decisions.

Beyond traditional loans, FinTechs offer a spectrum of customisable financial products, such as:

- Invoice financing, where MSMEs can get paid upfront for unpaid invoices and meet their short-term liquidity requirements

- Export financing, which helps MSMEs unlock immediate access to funds for exports and cross-border trade

- A flexible, pay-as-you-use financing option, enabling MSMEs to pay credit only on utilised funds and access more funds as they repay

- Furthermore, solutions like cash-flow-based lending focus on the borrower’s projected future and past cash flow data to determine their creditworthiness, eliminating the need for traditional collateral requirements

These on-demand working capital financing solutions are made accessible with a quick and easy one-time credit evaluation, meeting the rising demand for a fast, streamlined digital lending experience. That’s not all; the variety of solutions offered by FinTechs allows MSMEs to choose financing options that align closely with their operational requirements and growth trajectories.

- Quick access to funds

As 48% of SMEs are expecting faster credit as a service, FinTechs are stepping up with reproducible auto-decisioning models, transaction data analysis, and digital documentation capabilities to speed up onboarding.

The hallmark of FinTech-enabled MSME financing is the speed at which funds can be accessed. FinTechs use Artificial Intelligence (AI) and Robotic Process Automation (RPA) for on-the-spot decision-making, replacing time-consuming underwriting processes with real-time approvals. This agility is crucial for businesses looking to capitalise on time-sensitive opportunities, manage cash flow fluctuations, or navigate unexpected market shifts without the delays associated with traditional banking channels.

- Driving economic resilience

In a dynamic and often unpredictable business environment, the ability to adapt quickly is a competitive advantage. FinTechs empower MSMEs to enhance their resilience by providing them with the financial agility needed to respond at speed to changing market conditions. For instance, by embedding financial products at the point of need, FinTechs are addressing MSMEs’ demands for personalisation and convenience. With embedded finance, FinTechs can deliver a financial service—be it a loan or payment—as a seamless part of an existing user journey, on a platform or digital marketplace that the MSMEs already use.

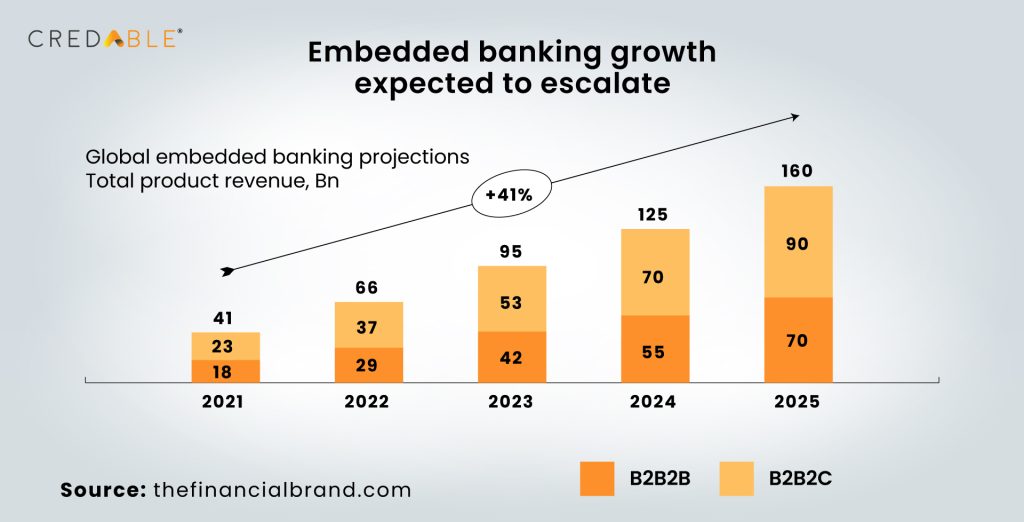

The global embedded banking projections highlight a surge in banks becoming Banking as a Service (BaaS) providers to expand their customer base and explore new revenue streams by offering financial products on popular digital platforms of non-bank companies.

Additionally, the Open Credit Enablement Network (OCEN) 4.0 protocol was launched to facilitate short-term loans and address the persistent challenges of the MSME credit gap.

Hrushikesh Mehta, Senior Vice President - Financial Services, at Open Network for Digital Commerce (ONDC), commented on how ONDC decided to add financial services to its offerings to transform the lending space for MSMEs:

“The idea is to bridge the gap between lenders and MSMEs through digital credit rails.”

Looking ahead: Future trends and opportunities

With their ability to deliver funds quickly and efficiently, FinTech platforms empower MSMEs to achieve sustained success in a dynamic marketplace. Whether it's scaling operations, investing in new technologies, or diversifying product offerings—MSMEs can make strategic decisions with confidence, knowing they have reliable access to timely financing solutions.

As technology evolves, so too will FinTech’s capabilities in serving MSMEs. FinTechs like CredAble are unlocking a new era of financial inclusion and transforming MSME financing by democratising access to capital and fostering resilience within India's entrepreneurial ecosystem.

Think Working Capital… Think CredAble!