How APIs are Fundamental in Embedding Services and Making Finance Frictionless

In today’s digital ecosystems—Application Programming Interfaces (APIs) are the connecting tissue.

APIs hold great promise for tech modernisation. They offer benefits from scalability to digital acceleration and business automation. Nearly 70% of respondents to a recent survey confirmed that they expect to increase API usage in 2023. With APIs taking on the role of de facto data pipelines, they have become key enablers of innovation. They are empowering businesses to forge profitable partnerships, monetise data, and explore new frontiers of growth.

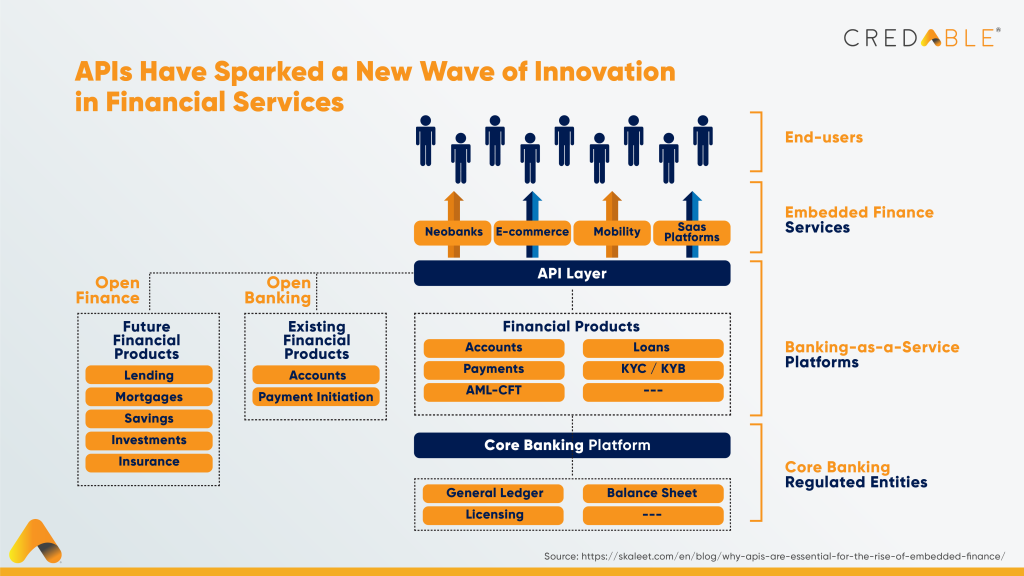

Building financial products is a complex process. It involves gaining access to the users’ financial data (with consent). Through open banking, third parties can utilise banking APIs to access data and build a whole new class of financial products.

It’s safe to say that open banking has paved the path to bring new financial service providers to the market faster and make frictionless finance a reality. In this article, we will look at the increasing prominence of APIs in shaping the embedded finance revolution.

APIs, the digital glue in the financial services sector

Today, customers demand the same level of convenience and innovation from their banks as they receive from tech giants like Google and Apple. As digital technologies continue to redefine the way financial services are delivered, there is a growing demand for better connectivity and access to broader and deeper financial ecosystems.

Banks are more than ever looking to provide digital-first services and compelling experiences across multiple customer touchpoints. APIs offer an easy and secure way for banks to do this. Banks can now open up their ecosystems to approved third parties via APIs and provide access to financial products and services across touchpoints that are not owned by them. By enabling the seamless integration of financial services into non-financial platforms, APIs have become fundamental in meeting the customers’ need for frictionless experiences.

In short, APIs are no longer a tech essential but a business priority for banks. As tools of differentiation, APIs are helping banks:

- Diversify their offerings

- Tap into new revenue streams

- Deliver enhanced customer experiences

Owing to the threat of disintermediation from big techs, we see banks now actively deploying APIs across core banking solutions. Banks are shifting their focus from service fulfilment to service orchestration by moving to next-generation digital banking architecture and embracing Banking as a Service (BaaS), and embedded finance solutions. In turn, FinTechs are rebuilding multiple layers of the banking stack and offering financial products “as a service” in addition to their core purpose-built software. APIs have become crucial for banks and FinTechs as they significantly reduce the cost, complexity, and speed of bringing new capabilities to the market.

Reaping the benefits of API and embedded finance

The future of financial services is becoming increasingly interconnected and invisible. We see financial products that are typically offered by banks embedded in the consumer and business apps that we use. Take for instance the ride-sharing app, Uber, they offer one-click payments where customers can make cashless transactions without leaving the app. Or the online retail giant, Amazon, which offers sachet-sized loans at the point of purchase in tailored ways to meet the specific needs of their customers.

Embedded finance has taken off in recent years, transforming the financial services landscape and becoming more of a global benchmark. CredAble’s modular and comprehensive BaaS tech stack is already powering leading banks, financial institutions, and emerging corporates globally. With an API-based co-branded working capital platform and embedded credit solutions, CredAble offers banks integrated offerings while providing businesses easier access to financing.

As FinTechs are now increasingly embedding API-based lending, payments, and banking services into consumer-facing apps, banks can create new revenue streams across digital interfaces that customers interact with daily. What’s more is that while banks benefit from embedding their services into third-party applications, they also gain access to new customer data. This treasure trove of data can then be used to build personalised and scalable financial products in the future.

According to McKinsey, there has been a significant shift in the goal of deploying API programs. While the key objective of API efforts for banks was to reduce IT complexity in 2020, the last year saw banks focused on leveraging APIs to unleash a new wave of innovation in financial services. The impact of API programs on revenue and cost also varies from one organisation to another.

The role of APIs in the future of finance is increasingly apparent

With the rising demand from customers to transact in frictionless and convenient ways, we see innovators stepping up to the challenge and embedding payments and banking services into their user experiences.

The business models of the future will be technology-driven and APIs are critical for any technological architecture. To navigate the digital age and maximise the potential of APIs, key players in the financial services sector need to rethink partnerships, develop a well-defined roadmap and accelerate the pace of development. At CredAble, we incorporate the latest API technologies to build end-to-end financial services that are scalable and customisable to meet the unique needs of the end user.